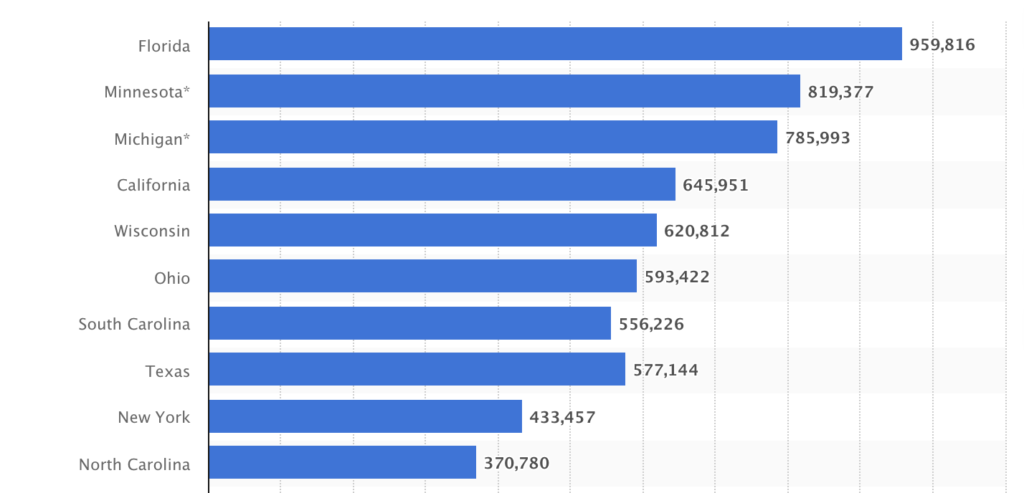

Boat ownership in Minnesota is second only to Florida (despite our weather being, um, less than half as good!). But here’s a better stat: Minnesota leads the nation in most boats per capita as of 2021.

Of course, we are famously called the “Land of 10,000 Lakes,” so it stands to reason. But Minnesota actually has 14,444 lakes of 10 acres or more, according to the U.S. Geological Survey. No wonder we love boating!

Of course, we are famously called the “Land of 10,000 Lakes,” so it stands to reason. But Minnesota actually has 14,444 lakes of 10 acres or more, according to the U.S. Geological Survey. No wonder we love boating!

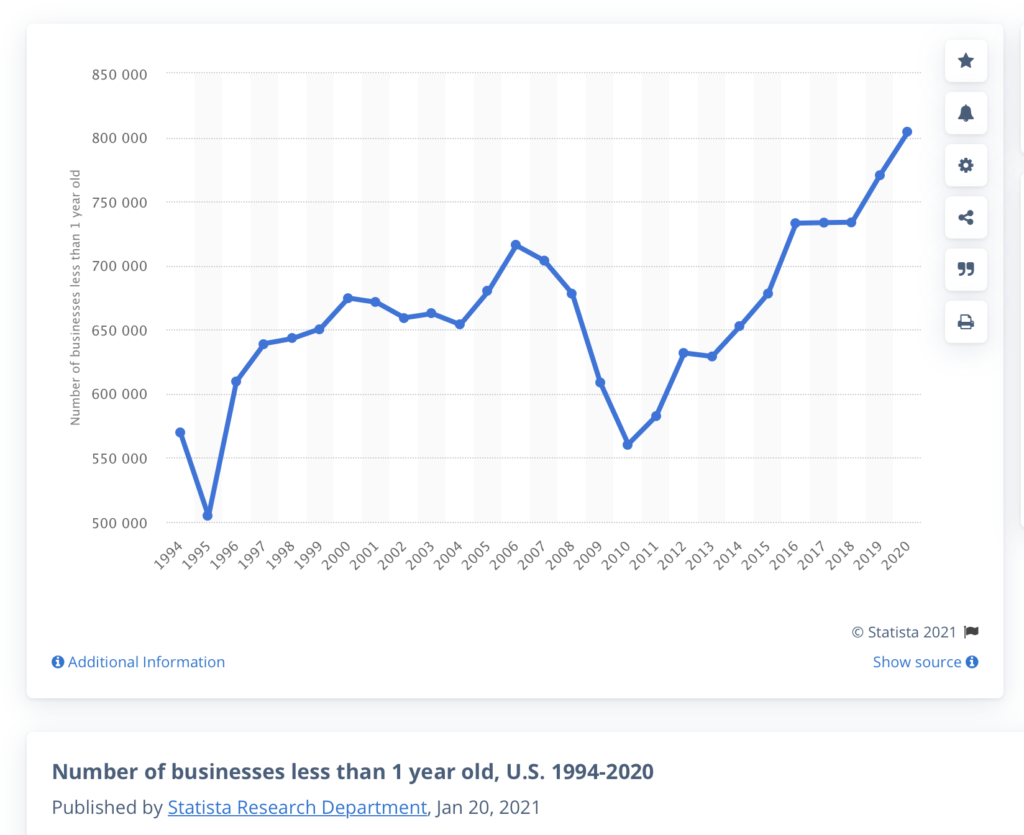

GetMyBoat is the world’s largest boat rental marketplace. Yes, it’s been called the  Airbnb of boats. Do people stay overnight in boats? Well, only the bigger ones that have such accommodations, I guess. But you can’t blame the company for liking the comparison. Most of their rentals, I’m suspecting, are a day at a time — though I’ve noticed week-long rentals are offered by some owners. But, surely, living on a big boat for a month while working remotely would be an intriguing escape for some digital nomads, no?

Airbnb of boats. Do people stay overnight in boats? Well, only the bigger ones that have such accommodations, I guess. But you can’t blame the company for liking the comparison. Most of their rentals, I’m suspecting, are a day at a time — though I’ve noticed week-long rentals are offered by some owners. But, surely, living on a big boat for a month while working remotely would be an intriguing escape for some digital nomads, no?

Big Money Can Float a Lot of Boats

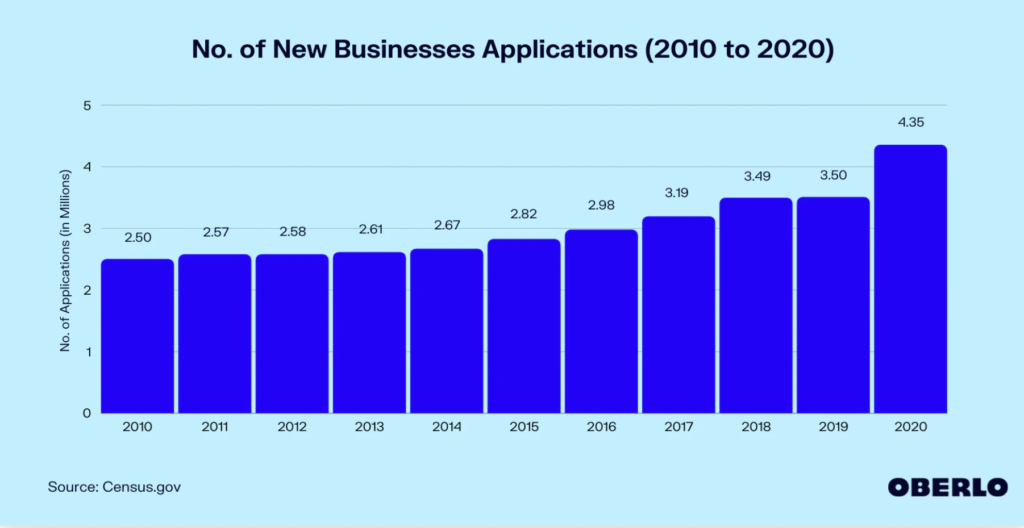

It should come as no surprise that boat owners in Minnesota have discovered GetMyBoat. And I suspect many more will be, as expansion is definitely in the works for GetMyBoat. It just announced it has received $21 million in a Series B funding, with boat manufacturing company Yanmar Global, based on Osaka, Japan, taking a majority stake in the company. Yanmar has worked with GetMyBoat since 2018.

In the past two years alone, despite the challenges experienced by the travel and leisure industries worldwide, GetMyBoat says it has achieved 10X revenue growth and now “offers more than 150,000 boat rentals and water experiences across 9,300 destinations.”

GetMyBoat has a mobile app for iOS and Android that enables users to rent a boat right from their phones. In the news release, the company said, “Our mission is to make the joys of boating more affordable and accessible, and with this growth capital from Yanmar, we will be able to fully realize that dream.”

GetMyBoat has a mobile app for iOS and Android that enables users to rent a boat right from their phones. In the news release, the company said, “Our mission is to make the joys of boating more affordable and accessible, and with this growth capital from Yanmar, we will be able to fully realize that dream.”

GetMyBoat is a fully remote company, with headquarters in Foster City, California. A large portion of its team is in South Africa, and it has employees in Toronto, North Carolina, Virginia Beach, and more.

The Local Connection

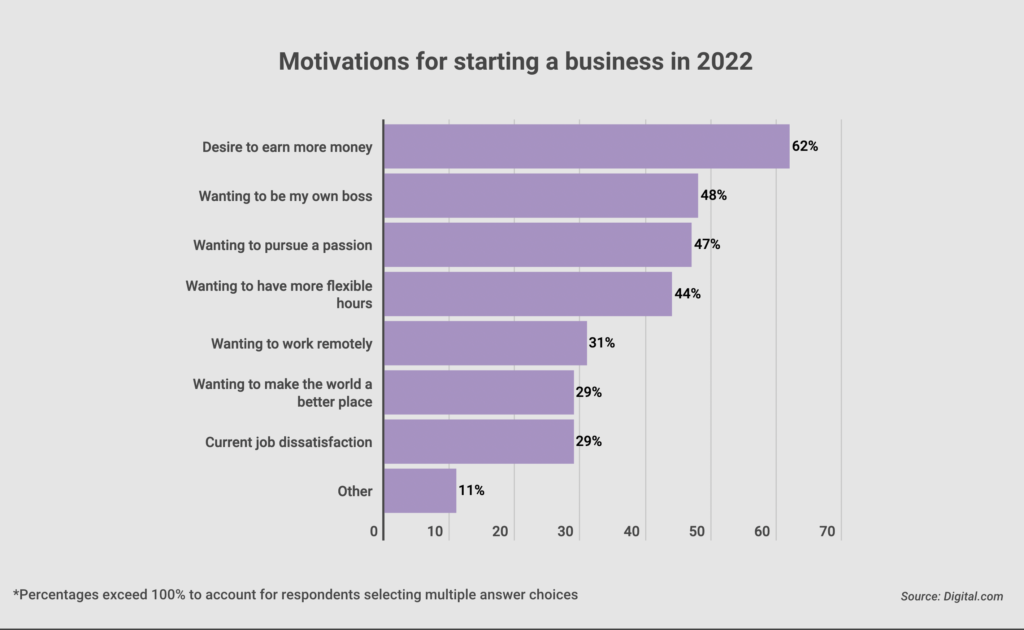

In Minnesota, the company currently has just one employee, but more than 85 watercraft owners are on the platform here as of March 2022. Of course, in the summer, I learned that number will increase a lot as owners “re-publish” their boats on the platform.  “I’m in close contact with some of our owners here,” said Val Streif, marketing manager, based in Northeast Minneapolis. “Many of them have reported really great stories of growing their side hustle businesses, renting out their boats in the summer months or serving as full-time boat captains for their rentals.” Hmmm, is this a way to ease the payment pressure from those 15-year boat loans many have to take out to live their dreams on the water?

“I’m in close contact with some of our owners here,” said Val Streif, marketing manager, based in Northeast Minneapolis. “Many of them have reported really great stories of growing their side hustle businesses, renting out their boats in the summer months or serving as full-time boat captains for their rentals.” Hmmm, is this a way to ease the payment pressure from those 15-year boat loans many have to take out to live their dreams on the water?

The only outside investor in GetMyBoat is Yanmar as of now. The company has been otherwise funded by the cofounders, serial entrepreneurs Sascha Mornell, CEO, and  Raf Collado. Quite the non-standard startup story! The company launched in 2013, and Yanmar invested for the first round in 2018.

Raf Collado. Quite the non-standard startup story! The company launched in 2013, and Yanmar invested for the first round in 2018.

All the Minnesota boats currently on the platform can be seen at this link. There’s a description for each listing saying what the owner/operator offers. The most popular listings in our state currently are on Lake Minnetonka, the St. Croix River, Prior Lake, and the greater Bemidji lakes area. (The photos in this post represent some of those offerings.)

The majority of GetMyBoat’s business is in the United States, but it has a large presence in the Caribbean, Canada, Mexico, and the Mediterranean, and Streif says the company is growing globally.

So what’s the range of watercraft sizes on the platform? I was told the smallest is a paddleboard (maybe I should rent mine?), and the largest are some superyachts (but none owned by Russian oligarchs, I have been assured!). And there are a whole lot of sizes in between — everything from kayaks and canoes to speedboats, cabin cruisers, pontoons, ski and wakesurfing boats, and even houseboats.

I asked Streif if all the larger boat rentals come with captain included. “No, people can choose boat listings based on this option,” she said. “I would say the vast majority of boat rentals on our platform are captained charters, but it’s not always the case. It will  say on the boat listing either ‘Captain is Included’, ‘Captain is Optional’, or ‘Captain is Not Included’.”

say on the boat listing either ‘Captain is Included’, ‘Captain is Optional’, or ‘Captain is Not Included’.”

For those rentals with no captain, I asked if the cost is high because of insurance expense. “It’s not necessarily super expensive when it comes to insurance.” she said. “We have some insurance partners that offer bareboat, or non-captained, coverage at competitive rates. The key for boat owners is to make sure, for their own insurance policy, that it covers bareboat rentals when they’re renting out their boats to  customers on the platform without a licensed captain.”

customers on the platform without a licensed captain.”

GetMyBoat sees itself as “the driving force in shaping the world of on-demand boating.” It says it’s on track to send 2,000,000 people boating before the end of 2022.

I have a feeling Minnesota will account for a growing number of those rentals as we get into the summer of 2022 — one we are all very much looking forward to, for obvious reasons.

See you on the lake!

Recent Comments