It was my pleasure to host an awesome group of founders at a conference on June 7, 2024 — all of them focused in data and AI. The conference attracted more than 1200 attendees. It was the seventh edition of the MinneAnalytics DATA TECH Conference, which took place at the Best Buy HQ Campus in Richfield, MN.

As a board member of MinneAnalytics, I again organized and hosted a “Startup Showcase” that morning. It was the 16th such session over the past decade that I’ve had the privilege of putting together. All told, MinneAnalytics has given a platform to a total of 139 startups in these showcases, which collectively have raised hundreds of millions in capital and created thousands of jobs. Already, a dozen of these startups have had successful exits via acquisition.

Our startup session this time continued the strong attendance we had at our last event, the April 19 Healthcare Conference (which I wrote about in my previous post). Attendance was again standing room during most of this session, and even more crowded for the VC Panel at the end.

Please do click on the links below to learn about each of these promising startups! They’re representative of the wide array of data & AI startups that are popping up all over these days. After the event, I asked each presenter, What was one good thing that happened to you because of your participation in this session, or one interesting contact you made?

STARTUP PRESENTERS’ FEEDBACK

Luke Roquet, Datavolo (Minnesota & Arizona): “We met some really interesting people from across town, but hearing what Philips Healthcare is doing and how we might be able to help them with their image processing pipelines was my top takeaway from the event.”

Kristopher Purens, Uroboros Innovations (Chicago): “We made several great connections with new people and reconnected with old contacts. Really valuable event for us. Panel discussion was very helpful, too.”

Dan Feehan, Code4pro (Minnesota): “Fantastic event. Loved the organization and straightforwardness of it all and the complement of the panel and timely AI discussion. I also loved how easy it was to connect with folks and understand their part of the ecosystem. I even ran into my best friend from 7th grade that I haven’t seen in 30 years! Great job by all presenters!”

Michael Petersen, Raise a Hood (Minnesota): “We came away from the event with a dozen new connections — potential investors, potential customers, and even potential partners. It was a day very well invested!”

Jeremy Vaughan, Start Left Security (Jacksonville FL): “Great event, great community! MinneAnalytics provides an example of what other cities can do for their tech folks and startups. Start Left Security made great connections with new partners and even have some investors chasing us down now!”

Toriano Sanzone, Dot Dog (New Orleans): “The Startup Showcase was truly impressive. I do wish I had brought more business cards and USB drives with my pitch deck, as the networking opportunities were exceptional. Presenting my company DOT DOG and Dog Training AI has boosted my confidence in the direction I am heading. Attending MinneAnalytics events is a priority for the rest of 2024, and I look forward to the possibility of presenting again in 2025.”

Jolly Nanda, Altheia (Minnesota): “It was a great event. I liked the opportunity to connect with my fellow startups, VCs, and supporters. I enjoyed the networking between sessions as well.”

George Asante, Affine Health Intelligence (Evanston IL): “It was great to be included in such a remarkable event.”

My sincere thanks to these amazing founders! They pitched their hearts out and captivated our audience.

PANELISTS’ COMMENTS

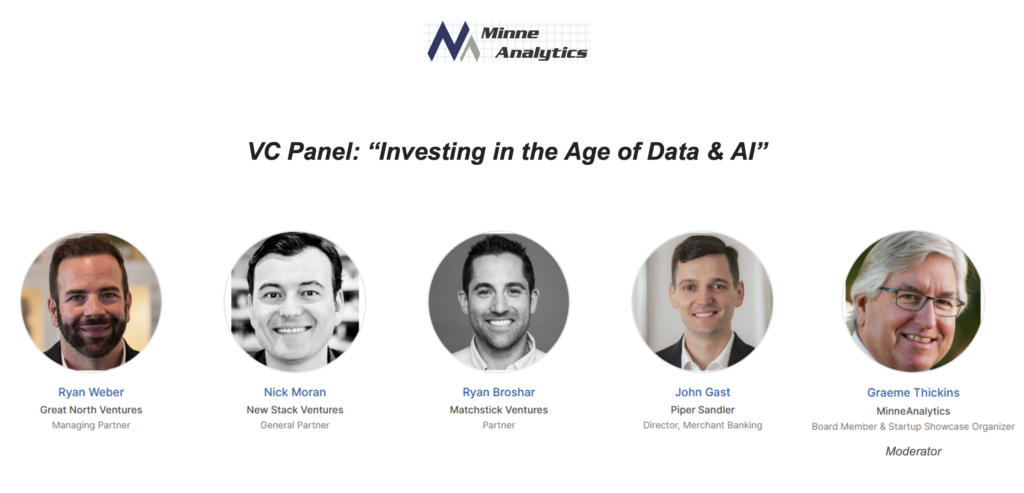

The panel following the startup pitches packed the room even further. The topic was, “How Are Investors Evaluating Startups in the Age of Data and AI?” After the event, I asked each panelist, What was the single best insight or comment you would cite from the discussion?

Ryan Weber, Great North Ventures (Minnesota): “I loved hearing from John about Piper’s cautious adoption given security concerns and protecting their clients — and from Ryan Broshar about how one of their portfolio companies is addressing it. Also loved Nick’s comment on the due diligence “BS call,” where they bring in an expert to chat with [a startup pitching them] to ensure they aren’t just big talkers. We do that, too, but I never thought of it so bluntly. It makes very clear the intention of that call. With all the hype and new jargon, [such a step] makes a lot of sense in this age of AI.”

Nick Moran, New Stack Ventures (Chicago): “I believe it was Ryan Weber that emphasized the importance of data in an AI strategy. This is an area we’ve been spending on a lot of time in as we think about defensibility and long-term moats. The comments really resonated and made me think about how that applies to our investments.”

Ryan Broshar, Matchstick Ventures (Minneapolis & Boulder) : “I liked the discussion around the adoption of AI by enterprises, and that we know they will be late adopters when it comes to any product they are building — but probably don’t know the extent to which their employees are already using it to improve productivity.”

John Gast, Piper Sandler (Minneapolis): “I enjoyed the discussion and appreciate how you moderated it, Graeme. It struck me that our collective remarks underscored how quickly this market is moving. We didn’t dwell on the fervor around LLMs in the last 12 to 24 months – instead, we had a rational discussion about the application of this technology to real problems.”

Really excellent panel! Thanks again, guys — and to all who attended and asked great questions.

I hope those of you reading this post can join us at our next Startup Showcase. Watch for an announcement in a future MinneAnalytics newsletter. If you aren’t on that list, please do sign up here. Join the almost 20,000 in the amazing MinneAnalytics community!

Hit the comments and let me know what you think, or if you have a question. Thanks!

Recent Comments