Angel investors are banding into networks at an increasing rate, especially in the Upper Midwest, and they’re getting a lot more savvy, I learned at a conference sponsored by RAIN Source Capital, September 28-29, in Mankato, MN. Separately, I also read recently that the number of angel-funded deals was up 15% in the first half of 2006.

Angel investors are banding into networks at an increasing rate, especially in the Upper Midwest, and they’re getting a lot more savvy, I learned at a conference sponsored by RAIN Source Capital, September 28-29, in Mankato, MN. Separately, I also read recently that the number of angel-funded deals was up 15% in the first half of 2006.

The RAIN organization, based in the Twin Cities, has already formed 17 networks in several cities and key regional centers in Minnesota, Iowa, North Dakota, South Dakota, and Montana. And it plans 10 more in the next year, expanding into additional states that include the Pacific Northwest. To say I was impressed by their “network of networks” model and how far it’s come in a short amount of time would be an understatement.  They appear to be out in front of a trend, meeting the market need to fill the infamous “gap” between very early-stage funding and traditional VC funding. It’s a gap many entrepreneurs have been more than frustrated with in recent years as they attempt to attract capital to get their ventures off the ground. And it’s the angels — increasingly smart bands of these angels — that are stepping up to fill that gap.

They appear to be out in front of a trend, meeting the market need to fill the infamous “gap” between very early-stage funding and traditional VC funding. It’s a gap many entrepreneurs have been more than frustrated with in recent years as they attempt to attract capital to get their ventures off the ground. And it’s the angels — increasingly smart bands of these angels — that are stepping up to fill that gap.

Key Things I Learned at This Event

• A recurring topic was that angels frequently see entrepreneurs who lack the ability to be coached. That was a word heard at the conference early and often. But, with their experience founding and running successful businesses, it’s not hard to understand that most angels want to invest in people who want and can take advice — that is, who realize they need more than money.

• In the U.S., there are currently about 200,000 angels, but only about 10% of them are organized into any group. That figure was courtesy of speaker Bill Payne, Entrepreneur-in-Residence at the Kauffman Foundation (pictured here).

• However, the number of angel groups is expanding, he said, and most of the approximately 250 that now exist in the country are so-called networks, which study deals together and make investments as a group. Less than 20% of that number, though, currently pools capital in advance and votes. Thus, Payne said, the RAIN organization, though it may be growing rapidly, has a ways to go yet before it can be considered “mainsteam.” There are lots of models out there, most based on what works in a local community, he said.

• The average angel deal, according to Payne, takes about five years until exit, and has about a 25% IRR (internal rate of return), which means a 3X return by the end of that five years. And most successful angels split their investing about 50-50 between early-stage and late-stage deals. “But,” he said, “it’s a bumpy, uneven road” to reach milestones. “And entrepreneurs lie, so we have to do multiple rounds.” He said that, of his 31 angel investments over the years, two deals took as long as 15 years to exit. Generally speaking, he said “You have to realize you’re in a decade-long activity.”

• How involved do angels get in their investments? “Most get very engaged,” said Payne, “but not necessarily in every portfolio company — they can’t possibly be. The beauty of a network is that someone from the group can ensure that all investments are being monitored properly.”

• What about valuation? Pre-money valuation is critical, said Payne, and he likes deals in the range of $1-3 million. His basic formula for ROI on an angel deal is quite simple: divide projected terminal value in year 5 by the post-money valuation (assuming no dilution). “But with an average overfall ROI of only 10-15%, you need a large portfolio to ensure success, and a 10-year commitment.”

• Diversification is the key, says Steve Mercil, CEO of RAIN Source Capital. “No one person can have enough expertise. The value of the network is what this is all about. It’s the ‘penguin concept’ — you jump in with others.”

• Can entrepreneurs be humble? “They have blind spots,” said Gene McGowan, a member of Prairie Winds Capital LLC angel network in Sioux Falls, SD, and a panelist in one of the sessions. “And we need to help them fill those. If they’re not open to a partnership relationship, that’s not good. They must be humble enough — it’s the smartest thing they can do, accept help in filling those blind spots.”

• What’s the most important thing an angel can do after he invests? “Know the controller!” said McGowan. Watch the financial statements, added another panelist, and be especially concerned if key people are leaving.

• What’s perhaps the second most important? “Dry powder,” said Jerry Okerman, former head of the 3M Company’s venture capital program, referring to follow-on investments. “You’ll need at least 50% more at the ready, maybe 100%.”

• What’s the one constant you can plan on? “Change,” said Cathy Connett, “and it’s always related to the people.” So, she said, angels and angel networks must always be ready to deal with that, and we heard again a reference to the “coachability” of the founder. Cathy has been an angel investor since 1993 and in now a member of one of the RAIN networks in the Twin Cities, the Sophia Angel Fund.

Billion-Dollar Buyouts of Upper Midwest Startups

In his opening-evening keynote at this event, Rich Karlgaard spoke of his favorite story about “small town America” tech startups in our region — that being Doug Burgum’s Great Plain Software in Fargo, ND, which Microsoft acquired in late 2000 for $1.1 billion.

But in the closing keynote after lunch the following day, we got to hear the story of yet another $1.1B acquisition: Midwest Wireless of Mankato, MN, which is being acquired by Alltel. Announced originally in November 2005, we learned the deal was actually expected to close just a few days after the event. The guy telling this amazing growth story was Dennis Miller himself (pictured here), the CEO and founder of Midwest Wireless (who plans to stay on with Alltel once the deal is final).  Miller said that Midwest Wireless began in 1990 with a handful of employees and a single tower in New Ulm, MN [one of my favorite towns, where the oldest brewery in the state, Schell’s Beer, still flourishes]. By the end of the ’90s, the company had 4700 towers. It made its first acquisition in 1996, a wireless company in Rochester, MN. By the year 2000, it had 234 employees and 110,000 customers and made another acquisition — this one for $165M — which expanded the company’s service area into Iowa and Western Wisconsin. By 2003, Midwest Wireless made a big bet: it switched over to CDMA technology, which Miller implied was a big challenge for the fledgling firm, but one they survived. By the end of 2003, his firm had grown to 507 employees and 356,000 customers, revenues had expanded to $179M, and it had made a second Iowa acquisition by the end of that year. Fast forward to the end of 2005, when the company had reached 636 employees and 440,000 customers, and $264M in revenues.

Miller said that Midwest Wireless began in 1990 with a handful of employees and a single tower in New Ulm, MN [one of my favorite towns, where the oldest brewery in the state, Schell’s Beer, still flourishes]. By the end of the ’90s, the company had 4700 towers. It made its first acquisition in 1996, a wireless company in Rochester, MN. By the year 2000, it had 234 employees and 110,000 customers and made another acquisition — this one for $165M — which expanded the company’s service area into Iowa and Western Wisconsin. By 2003, Midwest Wireless made a big bet: it switched over to CDMA technology, which Miller implied was a big challenge for the fledgling firm, but one they survived. By the end of 2003, his firm had grown to 507 employees and 356,000 customers, revenues had expanded to $179M, and it had made a second Iowa acquisition by the end of that year. Fast forward to the end of 2005, when the company had reached 636 employees and 440,000 customers, and $264M in revenues.

“What was our biggest challenge?” CEO Miller rhetorically asked. Not surprisingly, he said that was “dealing with rapid growth.” But another question he said he’s been asked more often recently is this: “Why exit?” Miller explained: “We could see the ‘Big Four’ were rapidly expanding their market share, and we could see that was at the expense of the smaller players. The ‘everybody else’ category was declining rapidly.”

In 2005, said Miller, “Things started to heat up.” Western Wireless, based in Seattle, was acquired by Alltel. Consolidation in rural wireless markets was underway, he said. So Miller and his management team started interviewing investment bankers. In July, the firm hired Bear Stearns and, by August or September, the auction process had begun. But it didn’t take long for the process to come to head: on November 19, 2005, Alltel announced its intent to acquire Midwest Wireless for just shy of $1.1 billion.

In retrospect, here are some of the impressive metrics Miller cited for Midwest Wireless: (1) His company’s shares saw an increase over this time period of 300%, and (2) the firm achieved a compound annual growth rate (CAGR) of 17.5%.

What key decisions could he look back on? an audience member asked. “We didn’t sell out in the crazy late ’90s,” said Miller. “We couldn’t see how those shareholders could win. If it’s too good to be true, then it probably is.”

Next question: How did your job change from 10 employees to 600+? “You learn what you do well, and you hire people to do the rest,” he said. “And then you let them do it!” Miller then offered up a great metaphor: “You give them rope, and — when you do that — you’ll find they more often tie bows than nooses.”

Final question from the angel audience: Why did you join the RAIN fund? [Miller has been a member of one of the networks, based in his hometown of Mankato, MN, for some time.] “It’s a great idea, and wonderful people. We’re all a part of a regional ecosystem,” he said. “If we can pool resources, we all win.”

Tags: angel investors, RAIN Source Capital, Kauffman Foundation, Midwest Wireless, Alltel

Angel investors are banding into networks at an increasing rate, especially in the Upper Midwest, and they’re getting a lot more savvy, I learned at a conference sponsored by

Angel investors are banding into networks at an increasing rate, especially in the Upper Midwest, and they’re getting a lot more savvy, I learned at a conference sponsored by  They appear to be out in front of a trend, meeting the market need to fill the infamous “gap” between very early-stage funding and traditional VC funding. It’s a gap many entrepreneurs have been more than frustrated with in recent years as they attempt to attract capital to get their ventures off the ground. And it’s the angels — increasingly smart bands of these angels — that are stepping up to fill that gap.

They appear to be out in front of a trend, meeting the market need to fill the infamous “gap” between very early-stage funding and traditional VC funding. It’s a gap many entrepreneurs have been more than frustrated with in recent years as they attempt to attract capital to get their ventures off the ground. And it’s the angels — increasingly smart bands of these angels — that are stepping up to fill that gap.

Miller said that Midwest Wireless began in 1990 with a handful of employees and a single tower in New Ulm, MN [one of my favorite towns, where the oldest brewery in the state, Schell’s Beer, still flourishes]. By the end of the ’90s, the company had 4700 towers. It made its first acquisition in 1996, a wireless company in Rochester, MN. By the year 2000, it had 234 employees and 110,000 customers and made another acquisition — this one for $165M — which expanded the company’s service area into Iowa and Western Wisconsin. By 2003, Midwest Wireless made a big bet: it switched over to CDMA technology, which Miller implied was a big challenge for the fledgling firm, but one they survived. By the end of 2003, his firm had grown to 507 employees and 356,000 customers, revenues had expanded to $179M, and it had made a second Iowa acquisition by the end of that year. Fast forward to the end of 2005, when the company had reached 636 employees and 440,000 customers, and $264M in revenues.

Miller said that Midwest Wireless began in 1990 with a handful of employees and a single tower in New Ulm, MN [one of my favorite towns, where the oldest brewery in the state, Schell’s Beer, still flourishes]. By the end of the ’90s, the company had 4700 towers. It made its first acquisition in 1996, a wireless company in Rochester, MN. By the year 2000, it had 234 employees and 110,000 customers and made another acquisition — this one for $165M — which expanded the company’s service area into Iowa and Western Wisconsin. By 2003, Midwest Wireless made a big bet: it switched over to CDMA technology, which Miller implied was a big challenge for the fledgling firm, but one they survived. By the end of 2003, his firm had grown to 507 employees and 356,000 customers, revenues had expanded to $179M, and it had made a second Iowa acquisition by the end of that year. Fast forward to the end of 2005, when the company had reached 636 employees and 440,000 customers, and $264M in revenues. Turns out Sevin Rosen, with a 30-year history in the venture capital business, is throwing in the towel on its latest fund and declaring the VC model is broken.

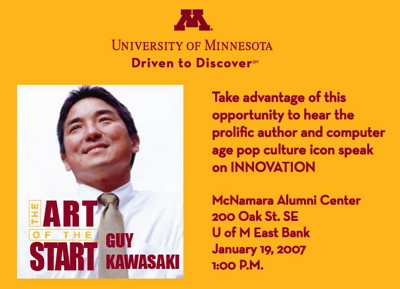

Turns out Sevin Rosen, with a 30-year history in the venture capital business, is throwing in the towel on its latest fund and declaring the VC model is broken. Rich Karlgaard of Forbes. [Or as Guy Kawasaki, another friend and business partner, calls him, “Brother Rich.”]

Rich Karlgaard of Forbes. [Or as Guy Kawasaki, another friend and business partner, calls him, “Brother Rich.”] One industry where this is happening is newspapers, with the stock of the New York Times, for example, at half what it was in 2002. Why is the industry in trouble? “Craig’s List is one reason,” he said, “a company with 23 employees.” He noted that McKinsey said the topple rate will triple again, and he gave some reasons why this volatility will stay with us. “The backside of Moore’s Law is the part that’s important. As performance increases, prices drop 30% a year. Suddenly, hundreds of millions more people can afford technology every year.” He also cited the example of Google bootstrapping its way early on, with the founders not taking equity investment but instead maxing out their credit cards.

One industry where this is happening is newspapers, with the stock of the New York Times, for example, at half what it was in 2002. Why is the industry in trouble? “Craig’s List is one reason,” he said, “a company with 23 employees.” He noted that McKinsey said the topple rate will triple again, and he gave some reasons why this volatility will stay with us. “The backside of Moore’s Law is the part that’s important. As performance increases, prices drop 30% a year. Suddenly, hundreds of millions more people can afford technology every year.” He also cited the example of Google bootstrapping its way early on, with the founders not taking equity investment but instead maxing out their credit cards.  Read more about that in

Read more about that in  “It’s growing at 70% year-over-year, and will have more ad revenue than the magazine by the end of 2007.” He said that’s what got Elevation Partners interested. “In the media business, as revenues double, valuation triples.” Forbes has very definitely become a global franchise. It’s seeing most of its growth on the Internet, and most of that growth is non-U.S. “But we’ll never give up on the magazine,” he said.

“It’s growing at 70% year-over-year, and will have more ad revenue than the magazine by the end of 2007.” He said that’s what got Elevation Partners interested. “In the media business, as revenues double, valuation triples.” Forbes has very definitely become a global franchise. It’s seeing most of its growth on the Internet, and most of that growth is non-U.S. “But we’ll never give up on the magazine,” he said.

Recent Comments