How’s your #VirusFreakout shutdown been going? I sure was bored. Not the whole time, but a good part of it. Waiting for clients to get going with writing projects and communications strategy engagements was the maddening thing that contributed mostly to my boredom — day after mind-numbingly slow day. So I decided to sit down and write about… what else? Boredom.

And I surprised myself. I discovered a fascinating topic! It turned out to be a wonderful way to relieve my own boredom. I learned there’s been much written about this topic in recent years — and especially in recent months. Yes, I was not the only writer to trip onto this topic to help pass the time of day.

In fact, I even discovered that boredom has been written about in the world of finance — stock trading, to be specific:

If You’re Bored, You Can Trade Stocks

I didn’t do that, mind you — and won’t. (I’m a buy-and-hold guy.) But here’s a key excerpt from the writer of this great financial newsletter: “The weird thing about the coronavirus crisis is that it simultaneously (1) caused a stock market crash and (2) eliminated most forms of fun. If you like eating at restaurants or bowling or going to movies or going out dancing, now you can’t. If you like watching sports, there are no sports. If you like casinos, they are closed. You’re pretty much stuck inside with your phone. You can trade stocks for free on your phone. That might be fun? It isn’t that fun, compared to either (1) what you’d normally do for fun or (2) trading stocks not in the middle of a recessionary crisis, but those are not the available competition. The available competition is ‘Animal Crossing’ and ‘Tiger King’.”

The author wrote about this phenomenon previously: “We talked last month about what I guess I will call the Boredom Markets Hypothesis, the idea that an important driving force in modern stock markets is the demand of retail investors for entertainment. The basic theory is that ordinary people will do more trading (1) if trading is entertaining and (2) if other things are less entertaining: The more bored they are, the more they will trade stocks.”

He goes on to cite a Bloomberg piece that supported his hypothesis: “Forget buy-and hold. Stuck at home and dreaming of a killing, bored retail traders are branching out into all manner of Wall Street exotica. Darting in and out of stock options, dabbling in complicated exchange-traded funds, devouring trading how-to books by the dozen — all have become tools in the self-directed portfolio playbook. Locked down and socially distant with lots of time and (apparently) money to spare, they’re leveraging zero-percent brokerage fees in new and surprising ways.”

And he adds this interesting little insight: “The number of investors at Robinhood currently holding the U.S. Oil Fund (USO), the biggest exchange-traded fund invested in oil, stands at 171,000, 20 times the number of users that held the fund in early March, according to website Robintrack, which uses Robinhood’s data to show trends in positioning but isn’t affiliated with it. The popularity of the fund only increased after negative oil prices captivated and confused traders…. Ordinarily, one thinks of retail traders as momentum followers who sell stocks when they go down. But when investments go down in an entertaining way—USO plunged in March, and has had troubles ever since, because it owns oil futures that can now go below zero—traders flock to it because, you know, at least they can feel something. ‘Ooh, a stock that can go below zero,’ they almost say, ‘that’s new, sounds fun, I want that’.”

I found that whole discussion extremely entertaining — in my own little boredom world. And I’m now hooked on this guy’s newsletter.

But I discovered so much more.

Bored games – Every day suddenly feels the same. That doesn’t have to be a problem.

We’re told by this writer to just let boredom happen… “even for just a short time, (it) allows us to think about what it is telling us. Maybe right now we can’t pursue all the things we normally find meaningful, but spending the time deliberately thinking about what matters most is never a bad thing. Then we can choose to act. The scope of what we do — learning a new language or just baking a cake — matters less than the fact that we are the ones doing the choosing.” Yes, you are the master of your boredom fate. So choose your cure carefully and happily, I guess.

Is It Burnout or Boredom? The Answer Matters.

Assuming it’s the latter, the author has this recommendation for entrepreneurs: “Marry your mission all over again. Over time, entrepreneurs occasionally lose sight of the reason they started their companies. If you’re having trouble connecting to your mission, you may need to revise it or at least get to know it again. See whether your original mission still matters to you, and rework it if it doesn’t. That way, you’ll feel more in tune with your company’s output, which should help energize your work. Re-examine your initial business plans, and revisit the places or memories that inspired you to open shop. Returning to your original passion will help you gain perspective on why it might not be a good fit any longer or how you lost your connection to it. Journaling and speaking with trusted mentors are two activities that can give you a sense of perspective, enabling you to rediscover your spark.” Imagine that — actually talking to people you trust can be a cure for boredom. Yeah, okay. Brilliant.

The Surprising Benefits of Being Bored

Many of us shy away from boredom, but it’s actually very good for creativity, according to one expert: Sandi Mann, a senior psychology lecturer at the University of Central Lancashire in the UK. “We lead incredibly busy lives, constantly hopping from one task to the next, and when we’re blessed with a little bit of downtime, we pick up our phones, and scroll the boredom away. But is that the best way use of our time?” Mann says boredom is an essential part of the creative process and should be applied to our day-to-day lives. She thinks we should try not to fear boredom when it hits us. “We should embrace it,” she says – a philosophy that she has now taken into her own life. “Instead of saying I’m bored when I’m stuck in traffic, I’ll put music on and allow my mind to wander – knowing that it’s good for me. And I let my kids be bored too – because it’s good for their creativity.” Of course, her whole professional career is about studying boredom, so of course she would train her kids.

Being Bored Can Be Good for You — If You Do It Right. Here’s How.

This one gets down to some prescriptives for all you millions of Covid shutdown folks out there. Here’s a long excerpt:

“If you’re waiting for brilliance to strike, try getting bored first. That’s the takeaway of a study published recently in the journal Academy of Management Discoveries [there’s a journal for that?], which found that boredom can spark individual productivity and creativity.” The article again cites Sandi Mann, who’s also authored a book entitled “The Upside of Downtime: Why Boredom Is Good,” and a proponent of embracing that emotion, negative connotations and all. Here are some ways she says being bored can be a good thing for your mind, imagination, and productivity, and how to do it right (these are article excerpts):

• As demonstrated by the new study and plenty others before it, boredom can enable creativity and problem-solving by allowing the mind to wander and daydream. “There’s no other way of getting that stimulation, so you have to go into your head,” Mann says. You may be surprised by what you come up with when you do (says the article).

• Step away from screens, work, and other stressors long enough to feel bored. Studies have shown, for example, that modern tools including work emails, social media, and dating apps can strain mental health — so taking a break can be a valuable opportunity to recharge.

• Mann says it’s important not to conflate boredom with relaxation. A purposefully tranquil activity, such as yoga or meditation, likely doesn’t meet the definition of trying and failing to find stimulation. To tap into true boredom, she suggests picking an activity that requires little or no concentration — like walking a familiar route, swimming laps, or even just sitting with your eyes closed — and simply letting your mind wander, without music or stimulation to guide it. [My emphasis there.] Mann says our cultural attachment to our phones is paradoxically both destroying our ability to be bored, and preventing us from ever being truly entertained. [Yikes, that’s a heavy insight!] “We’re trying to swipe and scroll the boredom away, but in doing that, we’re actually making ourselves more prone to boredom, because every time we get our phone out we’re not allowing our mind to wander and to solve our own boredom problems.”

Got that, phone phreaks?

The article has a great conclusion: “Next time you find yourself in line at the grocery store, in a tedious meeting, or killing time in a waiting room, resist the urge to scroll. You’re bound to get bored — and your brain, mood, and work performance just might improve.”

So, it’s all good — boredom is the best thing that could possibly come out of a total shutdown of our economy.

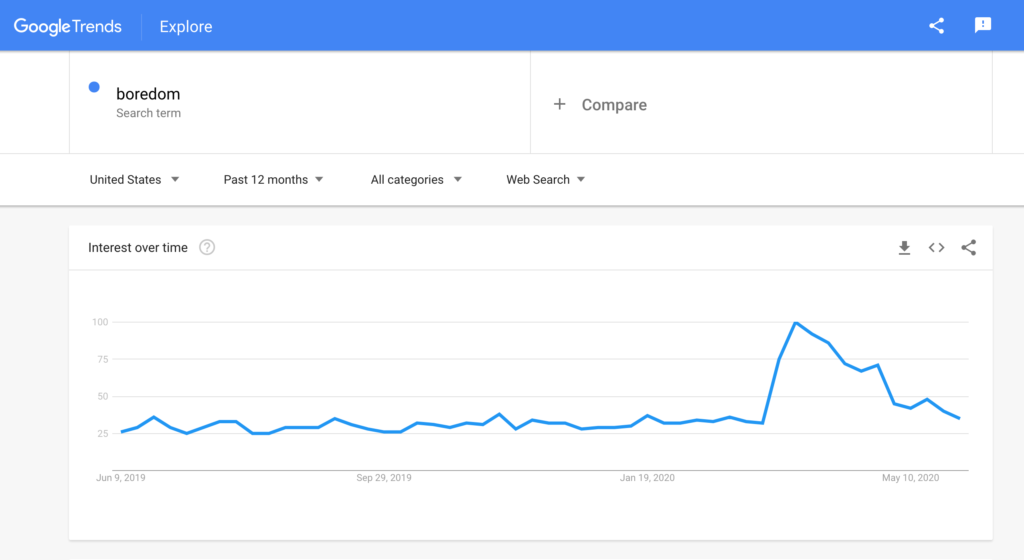

Yeah, right! But I’ve had enough of it for a while, thank you very much. And so have a lot of other people, as you can see from Google Trends:

Now I’m totally ready for the Big Open that’s coming our way!

———

P.S. By the way, to cure my boredom over the past couple of months, one thing I did was play carpenter. I replaced a large part of my deck and built a deck gate – from scratch! – the photos of which you see here. I dutifully posted these to my Instagram page (which I only go to when I’m really bored). What did you do?

Recent Comments