The Minnesota startup community turned out in big numbers on Friday, January 19 to hear Guy Kawasaki deliver his “Art of the Start” presentation. The main room at the McNamara Alumni Center was packed, with some 500-600 people, I’d guess, and a simulcast of the talk had to be set up across the river at the Carlson School for an overflow crowd. I managed to arrive a bit before 11:30 for the meetup I’d called a few days earlier, talked to a few folks (all kinds of people had arrived early), including some of my VC friends and bloggers, then was surprised to learn I was being invited into a special VIP lunch in advance of the talk in an adjoining room.  Never one to pass up a free lunch, and a chance to talk more informally with Guy, my all-time favorite evangelist and speaker, I seized the moment. And I’m glad I did. Got to chat with Guy, then he gave a real interesting, informal talk and took questions, which was fun. (A photo I include here shows Guy with Gary Smaby, left, and Dan Mallin, sharing some laughs after his lunch talk.)

Never one to pass up a free lunch, and a chance to talk more informally with Guy, my all-time favorite evangelist and speaker, I seized the moment. And I’m glad I did. Got to chat with Guy, then he gave a real interesting, informal talk and took questions, which was fun. (A photo I include here shows Guy with Gary Smaby, left, and Dan Mallin, sharing some laughs after his lunch talk.)

Guy talked about his love for hockey, and how he actually finds time to play five times a week(!) at his local rink in Silicon Valley. “Maybe I’m a Minnesota guy stuck in a Hawaiian body?” he mused. He also told us about his team, The Capitalist Pigs, which he brought along to compete in the U.S. Pond Hockey Championships at Lake Nokomis, where they’d played their first game at 8:30 that morning. Guy also told us his wife, whom he met at Apple, was originally from Minnesota. (Regarding the hockey tournament, two of the people instrumental in sponsoring Guy’s talk, Dan Mallin and Scott Littman, were also actively involved in that. More on the hockey event later.)

Since Guy is now a VC, he spoke about his firm Garage Technology Ventures, and explained that he and his partners all have a background in software and IT, so tend to invest primarily in that area, although they have also invested in an e-commerce company and even a “clean-tech” energy firm. The latter is in solar energy and is actually doing the best of any of his portfolio firms right now.

So, What Is It That Silicon Valley Has?

Guy said at lunch that one of the questions he’s asked most often in his travels as he speaks around the country is this: “How do we become like Silicon Valley?” He gave some interesting insights on this topic. First of all, it was really an accident that it happened the way it did, and other locales would have a hard time trying to replicate it. It’s a state of mind, he said, not just a place. The one factor that really makes a difference, Guy said he has learned, is “the quality of the Department of Engineering” at the local university, alluding to the role Stanford University has played in the Silicon Valley phenomenon. “Google was just two engineers with an idea to improve search. Cisco was an engineer who wanted to do routing.” He noted that it’s not so much the business school. “Those people go off to work for the investment banks and big consulting firms. It’s the engineering school you need to focus on.” To me, however, the most insightful comment he had on what makes Silicon Valley different was this: “Investors there have a willingness to lose. They’re not humiliated by losing.” He also pointed out that students and entrepreneurs there come from all over the world. “Nobody cares who your father was, like at the big East Coast schools.” These first-generation entrepeneurs are the ones to watch, he said. “Like the ones whose whole family has been working at the 7-11.” But he also pointed out that a lot of the Silicon Valley allure, and the success of startups there, has to do with luck.

A really fun thing about the lunch is that I got to meet some new Twin Cities-area VIPs and see others I hadn’t seen in years. For example, got to sit next to a guy I’d met early in my career in advertising: Fred Senn, the legendary behind-the-scenes guy at the Fallon Agency, who recently coauthored a great new book called Juicing the Orange. I highly recommend it; Fred described how he and Pat wrote it in a style “as if we were talking to you at a cocktail party.” Also chatted with Lisa Bormaster, publisher of The Business Journal of the Twin Cities, whom I’d emailed with but never met. And I met Doug Johnson of the U of M’s business development office, now called the Office for Technology Commercialization, which really played a big role in pulling off this whole event. Kudos to him and his associate director, Jessica Zeaske, and to all the sponsors. I say it was an off-the-charts success! And I know Guy was very impressed with the size of the crowd. I also know, after hearing more from him a couple days later, that he will be back….

Our Meetup of Local Developers and Bloggers

A lot of my friends turned out to chat beforehand (and after), as I’d encouraged them to in a blog post a week or two prior. After saying hello to Tom Kieffer, Gary Smaby, Jeff Hinck, and Jeff Tollefson, I ran into lots of the great MinneDemo folks — first Dan Grigsby, then I saw Kim Garretson, Tim Elliott, Asim Baig, Luke Francl, Ben Moore, Bruno Bornsztein, Garrick Van Buren, Rob Metcalf, Jeff Pester, and even an old friend from my BestBuy.com days, Jennifer Kemp. [And I may be forgetting a few — sorry. But it was a busy place!] Another contact from days past, Matt Geiser, is now with a software startup called SuperBuild. All told, it was a fun, if brief, get-together. But everyone seemed really stoked by Guy’s talk — which I knew they would be! (The shot I show here is of Bruno Bornsztein and Luke Francl before the event.)

The ‘Art of the Start’ Talk

Guy’s one-hour speech was fantastic, following his tried-and true “top-ten points with a bonus” technique. Rather than me trying to cover all the great insights, I say just get the book! A few of the keys he presented “for starting up anything” are worth mentioning, however. Point number one, of course, is to “Make Meaning” — not money, meaning. Then the money will take care of itself. And we all loved how he went after mission statements in his next point: “Make Mantra.” That means being able to reduce what you do, the difference you make, down to about three or four words, not twenty or thirty. The Dilbert Mission Statement Generator can do the latter (in corporate speak)! You have to deal with the much more important job of coming up with a mantra. Guy’s third point was especially important, I think, to Minnesota entrepreneurs: “Get Going.” What he said here was that you have to “stop looking for a perfect world.” He also said you have to learn to think differently, and that it’s actually good if you “polarize people…all great products and services do.” (The Mac being one prime example from Guy’s past.) And “find a few soul-mates.” A few is good, he said — because “you must balance off each other, and learn how to prop each other up when you need to.” What I really found fascinating about the admonition to “Get Going” was that it was a great follow-on to Dan Mallin’s announcement of a new initiative in his brief talk before introducing Guy.  It’s called GetGoMN.com. Click that link now and sign up now to get notified when it launches! (soon) I personally am very excited about this initiative…

It’s called GetGoMN.com. Click that link now and sign up now to get notified when it launches! (soon) I personally am very excited about this initiative…

And Then It Was Off to Hockey

After some good conversation in the networking that followed the event, the next thing on my agenda was to drive over to Lake Nokomis and shoot some pix of Guy playing hockey! He had mentioned previously at lunch that I could shoot some with his camera, too. So, off I went, only to discover I’d run out of battery! By the time I made a stop to correct that, I arrived too late to catch Guy’s 3:30 game. But I manged to get to his next one, at 9:30 Saturday morning, and took a bunch of shots at that one — starting with the shot you see here.  I uploaded several more shots to this Flickr set. And I got to shoot with Guy’s great Nikon camera, too — the coolest digital cam I’ve ever held! Two cameras hangin’ around my neck, and my fingers freezin’! (The wind chill was below zero.) I told him I just pointed and shot as fast as I could — hail mary, baby! Hey, shooting hockey action is not easy! I have a whole new respect for those sports photographers. But, like a monkey at a keyboard, sooner or later, I figured if I just kept shooting, something lucky might happen…. 🙂 Anyway, Guy told me later he liked the photos (or at least tried to make me feel good by saying that!), so maybe we’ll see some of the ones I shot with his camera show up on his blog.

I uploaded several more shots to this Flickr set. And I got to shoot with Guy’s great Nikon camera, too — the coolest digital cam I’ve ever held! Two cameras hangin’ around my neck, and my fingers freezin’! (The wind chill was below zero.) I told him I just pointed and shot as fast as I could — hail mary, baby! Hey, shooting hockey action is not easy! I have a whole new respect for those sports photographers. But, like a monkey at a keyboard, sooner or later, I figured if I just kept shooting, something lucky might happen…. 🙂 Anyway, Guy told me later he liked the photos (or at least tried to make me feel good by saying that!), so maybe we’ll see some of the ones I shot with his camera show up on his blog.

I know Guy had a great time here (and he did get a chance to take in both a Gopher and Wild hockey game with his teammates over the weekend). His appearance was a really great thing for our startup community, and I know the energy of the whole experience will carry on for a long, long time. Thanks, Guy, from all of us here in Minnesota! (Update: he just said in an email, “It was an honor and a pleasure!”)

Tags: Guy Kawasaki, Art of the Start, University of Minnesota, Carlson School, US Pond Hockey Championships, GetGoMN.com

Never one to pass up a free lunch, and a chance to talk more informally with Guy, my all-time favorite evangelist and speaker, I seized the moment. And I’m glad I did. Got to chat with Guy, then he gave a real interesting, informal talk and took questions, which was fun. (A photo I include here shows Guy with Gary Smaby, left, and Dan Mallin, sharing some laughs after his lunch talk.)

Never one to pass up a free lunch, and a chance to talk more informally with Guy, my all-time favorite evangelist and speaker, I seized the moment. And I’m glad I did. Got to chat with Guy, then he gave a real interesting, informal talk and took questions, which was fun. (A photo I include here shows Guy with Gary Smaby, left, and Dan Mallin, sharing some laughs after his lunch talk.)

It’s called

It’s called  I uploaded several more shots to

I uploaded several more shots to  It’s a project, I learned, that Gary’s been actively engaged in for about two years now. Gorgeous, striking work…as you can see.

It’s a project, I learned, that Gary’s been actively engaged in for about two years now. Gorgeous, striking work…as you can see.

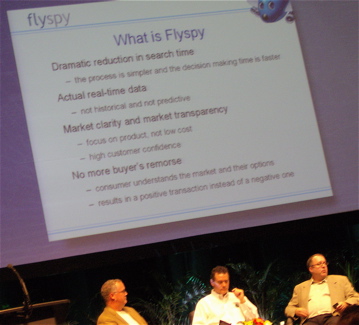

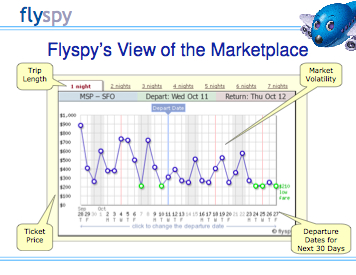

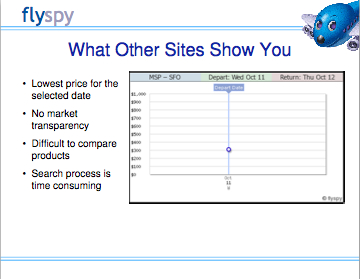

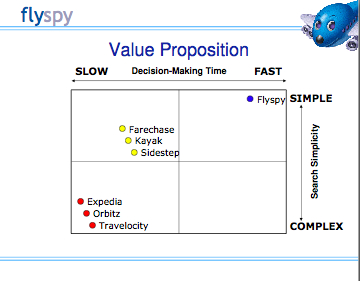

Robert Metcalf, the founder and visionary behind chart-based Flyspy, was invited a few weeks ago by the event’s producers to introduce his service at this high-profile annual gathering of online and traditional travel execs. He told me he had to think about it for a while, but ultimately decided, even though it’s still early (the site isn’t quite in full beta release yet), that it was just too tempting an opportunity to miss — to get the kind of reaction he could get here.

Robert Metcalf, the founder and visionary behind chart-based Flyspy, was invited a few weeks ago by the event’s producers to introduce his service at this high-profile annual gathering of online and traditional travel execs. He told me he had to think about it for a while, but ultimately decided, even though it’s still early (the site isn’t quite in full beta release yet), that it was just too tempting an opportunity to miss — to get the kind of reaction he could get here.

Rich Karlgaard of Forbes. [Or as Guy Kawasaki, another friend and business partner, calls him, “Brother Rich.”]

Rich Karlgaard of Forbes. [Or as Guy Kawasaki, another friend and business partner, calls him, “Brother Rich.”] One industry where this is happening is newspapers, with the stock of the New York Times, for example, at half what it was in 2002. Why is the industry in trouble? “Craig’s List is one reason,” he said, “a company with 23 employees.” He noted that McKinsey said the topple rate will triple again, and he gave some reasons why this volatility will stay with us. “The backside of Moore’s Law is the part that’s important. As performance increases, prices drop 30% a year. Suddenly, hundreds of millions more people can afford technology every year.” He also cited the example of Google bootstrapping its way early on, with the founders not taking equity investment but instead maxing out their credit cards.

One industry where this is happening is newspapers, with the stock of the New York Times, for example, at half what it was in 2002. Why is the industry in trouble? “Craig’s List is one reason,” he said, “a company with 23 employees.” He noted that McKinsey said the topple rate will triple again, and he gave some reasons why this volatility will stay with us. “The backside of Moore’s Law is the part that’s important. As performance increases, prices drop 30% a year. Suddenly, hundreds of millions more people can afford technology every year.” He also cited the example of Google bootstrapping its way early on, with the founders not taking equity investment but instead maxing out their credit cards.  Read more about that in

Read more about that in  “It’s growing at 70% year-over-year, and will have more ad revenue than the magazine by the end of 2007.” He said that’s what got Elevation Partners interested. “In the media business, as revenues double, valuation triples.” Forbes has very definitely become a global franchise. It’s seeing most of its growth on the Internet, and most of that growth is non-U.S. “But we’ll never give up on the magazine,” he said.

“It’s growing at 70% year-over-year, and will have more ad revenue than the magazine by the end of 2007.” He said that’s what got Elevation Partners interested. “In the media business, as revenues double, valuation triples.” Forbes has very definitely become a global franchise. It’s seeing most of its growth on the Internet, and most of that growth is non-U.S. “But we’ll never give up on the magazine,” he said.

Recent Comments