A favorite sport for entrepreneurs in the last five or six years has been complaining about how hard it is to raise early-stage capital — especially for the very early stage of a startup, sometimes called the prototyping phase. But, at an investment conference I attended a few days ago here in Minneapolis (conducted by NetSuds.com under the auspices of the Minnesota Association of Angel and Venture Capital), I heard some experienced investors talk about how things are changing for the better. Attendees numbered 136, including angels and VCs from throughout the region, as well as hopeful entrepreneurs considering the launch of a new startup and founders of tech firms that are somewhat further along. The program included several startup CEOs pitching their companies.

Time was, Minnesota had a reputation as a pretty good hotbed for tech startups, including IT, but it’s now much better known for its med-tech startup community, of course, especially medical device firms. At this event, however, I noticed a good mix of both IT and medical technology folks amongst the attendees and presenting companies. Here’s a look at what was the agenda for the event.

Bucks in the Boonies

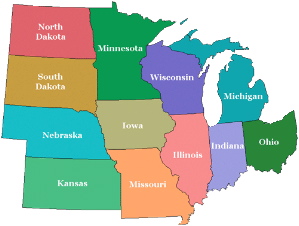

The opening speaker was a longtime contact of mine, Brian Johnson, who’s been a VC with smaller, early-stage venture firms here in the Twin Cities for more than 20 years. Since 2005, he’s been an EVP with RAIN Source Capital, which is is a multi-state network of angel funds. (RAIN is an acronym standing for rural angel investment networks.) It brings together like-minded angel investors to form individual RAIN funds, which share expertise, deals, and experience between and among RAIN Source Capital’s multi-state network to support growing companies throughout the area. It’s now working with angel investors in communities within Minnesota, Iowa, North Dakota, South Dakota, Montana, Idaho, Washington, Oregon, and other states. Its funds range in size from seven to 61 members, who have pooled anywhere from $500,000 to $2 million in each fund. Each individual RAIN fund determines its industry focus, and the type and level of financing to provide based on the interests and expertise of its members. And each uses the organization’s proven model for identifying potential deals, performing due diligence, making investment decisions, and monitoring those investments, said Johnson. The RAIN fund network currently has more than $20 million invested in 40 companies.

“The gap is starting to be filled by angel funds across the U.S., ranging in size from $500,000 to $5 million,” said Johnson, referring to the void created when traditional VC firms began reducing their early-stage investing after the dot-com collapse. RAIN Source Capital already has 13 funds in various out-state communities, and Johnson said the number will hit 20 by the end of 2006. “That will be more angel funds than any other organization,” he said. There are about 225 formal angel funds in the U.S., almost all of them in urban areas, according to Johnson. “Only one is primarily active in rural communities,” he said, referring to his own organization. But he noted his firm is moving to add more urban funds as well, including several soon in the Twin Cities area (one is a women’s angel network). A key thing his organization has learned is that its members see their networks as a “profitable, fun, social activity,” said Johnson. “It’s a big deal for them.” Each member’s minimum investment ranges from $25,000 to $100,000.

A speaker visiting from a neighboring state was Mike Jerstad of Prairie Gold Venture Partners, an early-stage investment firm based in Sioux Falls, South Dakota. Jerstad, whose firm is currently investing a $10 million fund, presented two interesting profiles: that of the ideal seed investor, and the ideal seed money recipient. He said the investor represents smart money, meaning he or she has both industry and entrepreneurial experience. “In addition, they’re value-added money, meaning they’ll roll up their sleeves, be an active board member, and provide business development assistance.” Finally, they’re “coordinated money,” Jerstad said, because they understand their role in the financing continuum, and how they help achieve the ultimate financing objectives. And the profile of an ideal seed money recipient? “He or she has spent a great deal of time perfecting the business plan,” he said. “They can speak in detail about needs and strategy, and recognize the need for both money and expertise — they really believe that.” They also must have a willingness to turn the strategy and business in a different direction — “and it’s best to do that early in the life of the business.” Finally, Jerstad said, “They realize the angel process is like the VC process — they’re ready for scrutiny. And they take a rifle approach to finding the best investors, being careful not to become a ‘shopped deal’.”

Jerstad, who was formerly based in in the Twin as an attorney and an investment banker in healthcare for Piper Jaffray, went on to talk about where a new startup should look for money today. “Regional angel groups are expanding. Regional VCs are not,” he said. “And get a referral — that is most important.” What should you expect? Jerstad stated the brutal reality: “Initial failure. Then more failure. But then you can get a break — typically through a connection.” And you have to be ready when it’s time for that “critical initial meeting.” Jerstad’s firm, Prairie Gold Venture Partners, will do seed funding, but typically prefers Series A. Its investments are in the range of $250,000 to $1 million, and the firm can lead $2.5-3.0 million deals. They have an Upper Midwest focus and consider themselves generalists, but they like life sciences, IT, food, and ag.

Words from the Wisest

Big draws for this event were a couple of very experienced, successful Twin Cities angel/early-stage VC investors. The first of these legends to speak was Norm Dann, who’s had a long career in the business, having been early in the game with a medical device firm that was acquired by Medtronic back in the ’70s. [And I remember him being an executive at the company when I worked there. He also has a son in the VC business, Mitch Dann, a former client of mine.] Norm went on to serve for many years as a partner with Pathfinder Venture Capital, funding all sorts of successful firms. He focused his talk on “Why don’t VC firms do more startups?” First of all, Dann said, “It’s a lot of work! A small deal is just as much work as a large deal.” He also pointed out that, as VCs’ funds have gotten larger, the number of partners has not really increased — meaning the workload of the typical partner has gone up greatly. “Another big problem is there’s just not enough info to determine valuations,” he said. He recommends putting in a dilution clause early, “because no one really has any idea what the real valuation is.” He also spoke about the role the investor plays in building the management team. “There are likely parts missing early on, and investors must fill that in.”

The other big draw was Ron Eibensteiner, a 30-year-plus seed stage investor with an enviable record — the closest thing in this town to the Midas Touch. Though Ron reminded us he’s had his share of dogs, moderator Matt Noah was quick to point out some of Ron’s successes: Stellent, Big Charts (acquired by CBS Marketwatch), Optical Solutions, and NextNet Wireless (acquired by Craig McGaw), just to name a few of the biggest. Eibensteiner made his first investment in a startup called Arden Medical Systems in St. Paul in 1983. [This was about the time I launched my startup consulting firm, and I’ve followed Ron’s career ever since. I never had the chance to work with him, but sure wish I would have.] Arden was soon acquired by Johnson & Johnson. After that, in 1988, he essentially became a full-time angel investor. His firm is Wyncrest Capital; here’s some directory info (there is no web site).

“We need a lot more early-stage funds!” crowed Eibensteiner. “When I started, there were a lot more.” He said his perceptions of the Twin Cities area is that “it’s almost dead compared to the ’80s and ’90s. It just hasn’t come back since ’01 and ’02.” Which makes raising money here tough — “One of the toughest things you’ll do. People are just reluctant to get involved.” In some respects, he said, “there’s too much money in venture capital” (causing the big firms to naturally want to fund the bigger deals). “But somebody has to fulfill the needs of early-stage companies.”

Eureka! Solution Found

Eibensteiner gave an example of a recent startup he’s actively involved in as an angel investor and board member: Travanti Pharma. The firm makes a wearable, disposable electronic drug delivery device, among other products. “First, we raised $1.5 million, which was hard,” he said. “Then, a couple of years ago, we needed more.” Lacking sources locally, he called an old contact of his, a retired principal in the San Francisco investment bank Robertson Stephens, who was living in Mexico at the time. He liked the idea and helped the company raise another $2 million. More recently, the company set out to raise its next round. “But this time it was $3-5 million, and we were now stuck ‘in between’,” said Eibensteiner, referring to the infamous gap. What he discovered, however, was a very interesting new state program in Missouri, which began about four years ago. It gives a tax break to insurance companies to invest to benefit their local communities, and the program has caused a number of new early-stage investment companies to spring up in the state. “Thirteen other states have done this, too,” he said, “We also got money from the state of Florida.” All told, Travanti Pharma ended up raising $8.5 million in its latest round, and had to turn away another $3 million.

Yet another example of one of Eibensteiner’s investments is a very recent startup called Yugma (Indian for “come together”), which offers a universal desktop sharing application in a hosted model. First, Ron showed it to the founders of locally based content management software firm Stellent (old buddies of his, of course). “They loved it — saw it as better than WebEx,” he said. They agreed to invest, but wanted the option to buy the technology if the rest of the round couldn’t be raised. That proved unnecessary, however, because Yugma ended up raising $1M instead of the $500,000 they originally sought (which bought half the company). “In two weeks,” said Eibensteiner, “we’re going to San Francisco to prepare for the next round.”

So, where does this leave early-stage investing in Ron Eibensteiner’s mind? “In the last year, it’s getting a little better.” But he still thinks it has a long way to go in Minnesota. So, recently, Ron — who has served as chair of the Minnesota Republican Party — made a proposal to Governor Tim Pawlenty. “I told him we’re at a critical stage,” said Eibensteiner. “We’re already falling behind as a tech state. It’s a job creation thing. The big companies aren’t adding jobs — it’s the early-stage ones that do that.” The proposal he made offers a real solution, he believes. “The state investment board currently has $50 billion under management. All I’m proposing is that 3/10ths of one percent of that — $150 million — be set aside for fostering more early-stage investing. Let’s do what Missouri did! Start 5 to 10 early-stage investment companies here in Minnesota.” Eibensteiner said “We should be on a per-capita basis with California and Massachusetts, but we’re nowhere near yet.” He thinks his proposal will become a reality in the next legislative session. And he even encouraged the launch of a new web site for some grass-roots support of his proposal — essentially a discussion board on the topic: InvestInMinnesotans.com. [I say get on it, sign up as a member, weigh in, and spread the word! And be ready to call your representatives when the bill comes up for a vote. This is the right move at the right time for our state.]

The Road from Seed to VC

The next session featured two relatively younger turks from VC firms that lean toward smaller deals. The first was Tom Erickson, a partner with Bluestream Ventures, which is based in Minneapolis but also has an office in the Bay Area. Its current fund is $280 million (2000), and it has six investment professionals. “We focus on the go-to-market stage in select IT sectors,” said Erickson,” so we like Series B or C.” The firm is particularly focused in data center, utility computing, and security technologies, and its average investment is $5 million over the life of the portfolio firm. “Oftentimes, one of our partners will participate as a member of the management team.” Their terms, not surprisingly, include “liquidation preference,” a fancy term for preferred shares. Earlier, both Ron Eibensteiner and Norm Dann had noted this is a fact of life in any deal, despite some founders being leary of it. Erickson said, however, that it can lead to a higher valuation.

Next up was Vimal Patel, a partner with Sierra Ventures in Menlo Park, CA. Founded in 1982, Sierra’s current fund is $500 million, and it typically invests $3-15 million per company, counting both initial and follow-on investments. “We do Series A, but our sweet spot is B and C,” Patel said. The firm’s focus is in general IT and Internet, and also (for Patel) materials science. The biggest thing about Sierra Ventures as relates to us here? “Two-thirds of our current investments are outside the Bay Area,” he said. “We’re invested in 45 companies, in Massachusetts, Florida, Texas, and elsewhere. We’d love to have a beachhead in Minnesota.” [Music to Minnesotans’ ears, indeed!] What are his firm’s needs? “We need proof of concept, customer validation, market size and competitive analysis, and the team at least somewhat identified,” said Patel. One final key point he added later: he actually reads cold emails! Fire yours off when ready to vpatel@sierraventures.com.

The Master’s Tips for Pitching to VCs

Ron Eibensteiner wasn’t done — we got a bonus: he gave the entrepreneurs in the audience a short-list of key points on how to pitch their startup, netting out what he’s learned over a lot of hard years of trial, error, failure, and success. Four things: (1) The concept — does it makes intuitive sense? It should not require a lot of explanation … (2) Is there an immediate sense of huge market size or need? … (3) What is the solution, including the marketing solution? How many obstacles are there? You need a marketing scheme that’s unique … (4) Execution — which gets right at the management team. People say this is the most important consideration, but only if the other three things are in place first, Ron pointed out.

“And do it all in 20 minutes,” he said. “Even if you just get through points 1, 2, and 3 successfully, you’ll get invited back.” He also gave advice about another kind of preparation: “Learn about the VC first!.” If it’s a larger size firm, you’re less likely to be successful. “Know their area of expertise, go for specialization.” Another point he made that drew some laughs was this: “If the VC firm’s decision-maker is under 35, forget it!” — meaning MBAs without operating experience. “Look for partners with entrepreneurial and operating experience,” said Eibensteiner. He harked back to his success raising funds for Travanti Pharma at the early-stage investment firm in Missouri — there, he worked with a 52-year old who’d been in immunology all his life and had just recently become a VC.

Highlights from the Q&A

Some audience questions addresssed to the panelists afterwards were of interest. “What about ‘Minnesota Nice’?” (Meaning the style of local entrepreneurs compared to the more hype-laden West Coast approach.) Erickson of Bluestream said that honesty is always the best policy. Eibensteiner said, “Paint enough of a picture to see the possibilities. Watch out for unrealistic expectations.” Patel of Sierra Ventures noted that his firm doesn’t so much pay attention to revenue projections, but looks for realistic market size. “What about those who say to double the amount you think you’ll need?” Patel said his firm looks at comparables in the same sector to get the best feel for how much you’ll need. “What about the exit strategy?” Eibensteiner said that’s a “total turnoff when brought up by a company early on.” Another question was “What about syndicated deals?” Erickson of Bluestream said they’re a must due to uncertainties. Patel of Sierra said they’re not a must for his firm; they do deals both ways, and will serve as a new lead in Series B or C. Ron Eibensteiner had a point to make from hard experience: “If you accept a syndicated deal, make sure the ‘lead’ really speaks for the group.” (He ran into a big problem with one of his investments because of this.) Finally, an excellent question from moderator Matt Noah: “How long will you give a non-realistic CEO?” (Meaning a founder who may know the technology well, but not really be qualified to run the company longer term.) Eibensteiner again offered up some wise words: “I always say ‘Put your ego up on the shelf’ for the duration of my investment.” And he cited a recent example of that very situation, where a founder agreed with him that it was time for him to give up the CEO reins.

My Take on a Big Area of Needed Improvement

Okay, now for some editorializing. [I write the blog, I get to editorialize… 🙂 ] After the morning break, the conference moved into a session of six company presentations by startup CEOs (12 minutes each), which I sat through. (There were five more firms that presented in the afternoon, but I was not able to stay for those.) To me, this was the most disappointing part of the conference. The presentations were largely lacking in content, organization, persuasiveness, and just plain-old excitement or drama. I think Minnesota entrepreneurs have a problem besides lack of available capital. They need to pick up the pace and quality of their pitches! One in the morning session that wasn’t too bad, at least in quality or appearance of the presentation itself, was NetBriefings — but it should have been, since that’s the business they’re in. All presenters could have used a serious dose of Guy Kawasaki’s “Rules for Powerpoint,” at least! That’s a basic starting point. To me, the quality of the presentation is the one big other reason why Minnesota startups don’t keep up with their brethren in other areas of the country. One need only look, for example, at how hard company presenters work at perfecting their pitches for the “DEMO” conference, which I attended in February and blogged about extensively. [Click on my “DEMO 2006” category to the right to see it all.] You can even watch videos of these presentations (including those that won a “Demo God” award) here — just click on “Watch DEMO Videos” at the right. If this doesn’t provide some inspiration for you, then there’s something wrong! And these pitches are limited to only six minutes each — which is a better exercise for entrepreneurs, I think, than stretching it out to twelve. [End of editorializing…]

Closing Thoughts and More Links

Interestingly, the day I’m about to publish this blog post, up pops a nice piece in the Wall Street Journal, entitled “Fresh Crop of Investors Grows in Silicon Valley: Start-Up ‘Angels’ Blossom Again”. Speak of the devil. But it sure is nice to know that it’s happening here in our state, too — albeit in a lesser way.

For some good local background, here’s a media piece from some months ago written by my friend Dave Beal, a business columnist at the St. Paul Pioneer Press: “Business to ‘angels’: Sow us the seed money”. The first half of the article is about the RAIN Source angel funds organization (which, at the time of this article, was still known as the Minnesota Investment Network, or MinCorp — glad they got some naming religion!), while the latter part of the piece is about Ron Eibensteiner’s proposal to get the State of Minnesota to boost seed-stage funding; you’ll note it began as a bid to get $500 million in funding from the state investment board, but was since lowered to a more realistic $150 million. [That’s cool, Ron — get what you can!]

Other events in this series of conferences sponsored by NetSuds, a MN-based networking organization, are listed here.

Finally, another resource that may be of interest to Minnesota startups is this MN Growth Capital Directory, published by the good folks at Minnesota Business Magazine a while back. It’s in need of a bit of an update now, but useful nonetheless — listing VC firms and community development agencies, though not yet the newly sprouted angel networks.

Speaking of those, yet another excellent organization just now in the final stages of formation is Twin Cities Angels LLC (the web site is not quite up as of this writing, but should be soon). It has signed on somewhere in the neighborhood of 40 angel investors to date, each investing $50,000 — making it a $2 million fund (but members will be allowed to place “side bets” beyond that, of course). The group is having its kickoff meeting on May 16. I met with the organizer, John Alexander, a few months ago, and some of my IT-oriented angel colleagues are signing on, in addition to several in med tech and other industries. It, too, is sure to bring more needed help to the fund-starved startups of Minnesota! So, stay tuned for more from me on the “Twin Cities Angels” network…

Rich Karlgaard of Forbes. [Or as Guy Kawasaki, another friend and business partner, calls him, “Brother Rich.”]

Rich Karlgaard of Forbes. [Or as Guy Kawasaki, another friend and business partner, calls him, “Brother Rich.”] One industry where this is happening is newspapers, with the stock of the New York Times, for example, at half what it was in 2002. Why is the industry in trouble? “Craig’s List is one reason,” he said, “a company with 23 employees.” He noted that McKinsey said the topple rate will triple again, and he gave some reasons why this volatility will stay with us. “The backside of Moore’s Law is the part that’s important. As performance increases, prices drop 30% a year. Suddenly, hundreds of millions more people can afford technology every year.” He also cited the example of Google bootstrapping its way early on, with the founders not taking equity investment but instead maxing out their credit cards.

One industry where this is happening is newspapers, with the stock of the New York Times, for example, at half what it was in 2002. Why is the industry in trouble? “Craig’s List is one reason,” he said, “a company with 23 employees.” He noted that McKinsey said the topple rate will triple again, and he gave some reasons why this volatility will stay with us. “The backside of Moore’s Law is the part that’s important. As performance increases, prices drop 30% a year. Suddenly, hundreds of millions more people can afford technology every year.” He also cited the example of Google bootstrapping its way early on, with the founders not taking equity investment but instead maxing out their credit cards.  Read more about that in

Read more about that in  “It’s growing at 70% year-over-year, and will have more ad revenue than the magazine by the end of 2007.” He said that’s what got Elevation Partners interested. “In the media business, as revenues double, valuation triples.” Forbes has very definitely become a global franchise. It’s seeing most of its growth on the Internet, and most of that growth is non-U.S. “But we’ll never give up on the magazine,” he said.

“It’s growing at 70% year-over-year, and will have more ad revenue than the magazine by the end of 2007.” He said that’s what got Elevation Partners interested. “In the media business, as revenues double, valuation triples.” Forbes has very definitely become a global franchise. It’s seeing most of its growth on the Internet, and most of that growth is non-U.S. “But we’ll never give up on the magazine,” he said.

It’s the first round of VC funding for HotGigs, which said it would use the funds to expand its management team, hire more employees, develop new product/service offerings, and launch national sales, support, and marketing efforts.

It’s the first round of VC funding for HotGigs, which said it would use the funds to expand its management team, hire more employees, develop new product/service offerings, and launch national sales, support, and marketing efforts.  It was also the first institutional round of funding for Jumpnode, which had secured its initial funds from angel investors in 2005. Jumpnode said it would use the new capital to expand its executive team, accelerate product development, and expand its sales and marketing programs on a national basis.

It was also the first institutional round of funding for Jumpnode, which had secured its initial funds from angel investors in 2005. Jumpnode said it would use the new capital to expand its executive team, accelerate product development, and expand its sales and marketing programs on a national basis.

Recent Comments