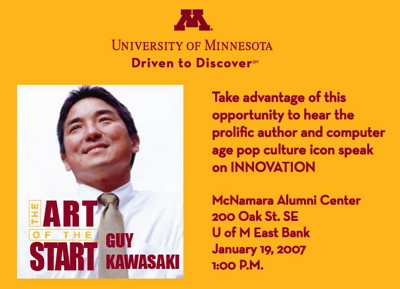

Was I surprised yesterday morning to learn that Guy Kawasaki, master evangelist/author/speaker from Silicon Valley, would be speaking at the U on January 19! After grabbing tickets for myself and a guest, I immediately emailed Guy and asked him how we could be so lucky to entice him here to Minnesota smack in the middle of winter. [I email with Guy once in a while, and we have a mutual friend in Rich Karlgaard of Forbes. See my coverage of Rich’s latest MN speech.]

Well, guess what what brings Guy here? [Other than a chance to talk "The Art of the Start."] It’s about pond hockey! Which has quietly become a really big deal, and Minneapolis is ground zero for this newly revived and now organized sport. I should have known hockey had something to do with this, because I knew Guy was huge into playing the game. Not that he doesn’t like coming to our state on general principles, mind you. I was instrumental in recruiting him to speak at a MN High Tech Association event several years ago, and I remember hearing him speak here in the mid-’90s when he was still an Apple Fellow. Guy, as you’ll recall, was the original evangelist for the Mac starting in the mid-’80s, which he wrote about in his first two books, "The Macintosh Way" and "Selling the Dream."

So, I asked Guy in my email if I could do a little interview to use in my blog post. He was game, so here ya go…

Me: Guy, what did we do to deserve this?

Guy: I’m playing in the pond hockey tournament. That was the enticement. 🙂

Me: What’s the gist of the talk?

Guy: I’ll be talking about "The Art of the Start" — based on my book, of course. It’s my guide for anyone starting anything.

Me: How long will it be, and what’s the format?

Guy: Sixty minutes, top ten format with a bonus. [If you read Guy’s books or blogs, you know he loves lists of ten.]

Me: Will you bad-mouth VCs (we hope)? <ha, ha>

Guy: I always tell the truth.

Me: Will you talk story about Steve Jobs and Apple?

Guy: Yes, a great deal.

Me: How much will you talk about hockey? Hey, how can you NOT here?

Guy: Depends on how we’re doing in the tournament. I think I play in a game before I speak.

Me: Will you have books for sale? And willyou sign my entire collection ? 🙂

Guy: I should arrange for a bookstore to be there. I’ll try to make this happen. See you soon!

What a guy! If you haven’t yet registered, act fast — word is spreading. Complimentary tickets for Guy Kawasaki’s talk on January 19th at the U of M are available by RSVPing at www.TheGuestRegister.com/start. You can register yourself and guests at the same time. Or call 888-889-7787, Event #932. Mucho thanks for this event go to the sponsors: the U of M’s Venture Center, the Center for Entrepreneurial Studies at the Carlson School, the James J. Hill Library, SDWA Ventures, and PR firm Haberman & Associates. I see Haberman is a co-producer of the U.S. Pond Hockey Championships here in January. Way to go, guys!

[By the way, Guy’s latest blog post is an interview of my friend Marti Nyman at Best Buy.]

Tags: Guy Kawasaki, Art of the Start, Apple Computer, Steve Jobs, evangelism, The Mac

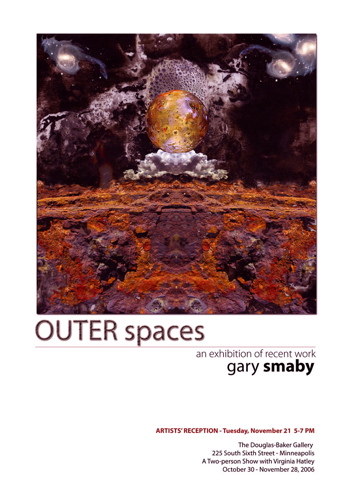

It’s a project, I learned, that Gary’s been actively engaged in for about two years now. Gorgeous, striking work…as you can see.

It’s a project, I learned, that Gary’s been actively engaged in for about two years now. Gorgeous, striking work…as you can see.

Turns out Sevin Rosen, with a 30-year history in the venture capital business, is throwing in the towel on its latest fund and declaring the VC model is broken.

Turns out Sevin Rosen, with a 30-year history in the venture capital business, is throwing in the towel on its latest fund and declaring the VC model is broken. This is just my first post of what will be many for DEMOfall, and I’m looking forward to it.

This is just my first post of what will be many for DEMOfall, and I’m looking forward to it. Haven’t seen the official list of all the presenting companies yet from the DEMO PR folks (and it may actually still be getting finalized). But if you search on “DEMOfall 2006,” you’ll see some companies are already promoting their selection to pitch at this event — names such as 4INFO, Simple Star, Add Me, MyPW, Headplay, Koral, Scrapblog, Mvox, and SiteKreator, to name a few.

Haven’t seen the official list of all the presenting companies yet from the DEMO PR folks (and it may actually still be getting finalized). But if you search on “DEMOfall 2006,” you’ll see some companies are already promoting their selection to pitch at this event — names such as 4INFO, Simple Star, Add Me, MyPW, Headplay, Koral, Scrapblog, Mvox, and SiteKreator, to name a few.

Recent Comments