Seth Levine is a VC in Boulder, CO, a partner with Foundry Group. I kinda know Seth, through his connections to the Twin Cities (he’s a graduate of Macalester in St. Paul), though we’ve never actually met. We’ve emailed quite a bit about goings-on here in Minnesota, after having just missed each other at the Defrag conference in Denver last November. Seth and his fellow partners are quite the bloggers. One of his sidekicks, Brad Feld (whom I did meet at Defrag), has a very popular blog called Feld Thoughts. And they also run another blog that has high readership in the entrepreneurial community called Ask the VC.

Seth’s blog is called Seth Levine’s VC Adventure. And, recently, he began a series of posts on startup advisors, a topic near and dear to my heart.

In a departure for Seth, the posts are actually written by a guest poster, Gerald Joseph. Part I was good, but Part II is even better: The role of company advisors (Part II).

Here’s how Seth explained how these posts came about:

“One of the things I enjoy the most about writing this blog is the discussion I engage in with readers – both through blog comments and in direct emails. Over the past month I’ve had a particularly enjoyable exchange with Gerald Joseph. One of the topics we’ve discussed is the role of advisors in the life of a start-up. I generally think of advisors as non-paid ‘friends of the company’ and as you’d probably guess, advocate a pretty deliberate organization and use of advisors. Gerald’s view is a little more expansive as he thinks of ‘advisors’ as the larger ecosystem that surrounds (or should surround) a start up company – one that includes people you pay (attorneys, CPAs, etc) and the people who pay you (your angel investors) in addition to the business and industry experts that are the typical ‘advisors’ to young companies. I like this line of thinking and offered Gerald the chance to put his thoughts into a post. He took me up on that idea and came up with a four part series on the topic that I’ll put up over the next few weeks. After the final post I’ll summarize some of my thoughts as well as comments from readers.”

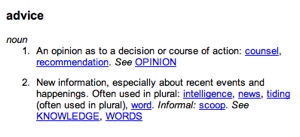

For entrepreneurs at any stage, I think these posts are excellent. I encourage anyone who could use some…uh…advice on how to use advisors to read them all, including Parts III and IV yet to come.

“The Walking Rolodexes…If you are an early stage company founder, these persons are often difficult to deal with since they are usually interested in cash not illiquid stock”

I would put most of the professions – lawyers, accountants, marketers, writers, designers, etc. – in the cash category also.

Thanks for the link, it was definitely worth reading Seth posts.

Thank you For The post