North Dakota has a lot going for it. The state embodies many good, positive things. The spirit of the pioneering American West. The frontier. Teddy Roosevelt. Hard work. Endless possibilities. Family values. The great American farmer. It also happens to have one of the best damn football programs in the entire U.S.A.: the NDSU Bison. Oh, and not the least, a booming economy.

I consider myself lucky to live in the next-door state, where I can closely admire what’s going on there. So, early Thursday morning, February 20th, I jumped in my car and headed Northwest to Fargo to attend the annual “Economic Outlook” luncheon event put on by the Fargo-Moorhead-West Fargo Chamber of Commerce.

It was fantastic! I’d only heard about it a few days earlier, in one of the email newsletters I get regularly from the fine folks at the Emerging Prairie organization. (Thank you, Greg.) I knew it would be a bit of a time investment — a seven-hour round trip! But I happened to have the day open, and I quickly decided I just couldn’t miss the main speaker, my friend Rich Karlgaard (who happens to be a native of Bismarck, North Dakota).

Rich is the longtime Publisher of Forbes and a well known futurist and speaker, whom the Chamber described as “one of the most influential and respected figures in the technology, economic, and business worlds. He advises audiences on how to harness an organization’s disruptive spirits to maximize business opportunities in the global marketplace. He’s also a regular panelist on one of cable news’ most popular business shows, Forbes on FOX.” Rich has a long bio, and you can learn more about him here, including his many great books. He’s one of my all-time favorite people in the tech business! We originally met some 20 years ago, and I manage to connect with him from time to time.

I arrived about 40 minutes early and was lucky enough to run into Rich as soon as I walked in. So we had a nice chance to catch up before the crowd started arriving. The event was held in a huge ballroom, and Rich drew a full house of business leaders. It was a packed, high-energy affair!

As we chatted in the big room, just as it was starting to fill, he saw his friend and colleague Doug Burgum, the noted software founder, VC, and now the Governor of North Dakota, walk into the room. So, we headed over to chat with him. I of course know Doug’s VC firm, Arthur Ventures, quite well and regularly stay in touch with some of the folks there. But Doug has been focused on serving as Governor since assuming that office more than three years ago. He was slated to give some opening remarks.

Times Are Good in North Dakota

“Every region in the country would trade places with us,” Doug declared after taking the stage. “There’s never been a better time for us here!” Then he started ticking off a list of ratings for his state:

• #1 Best Place to Raise a Family

• #1 for Millennials

• Fargo is the #1 Hottest Job Market, with Bismarck (the capitol) coming in at #9

• And, as we’ve all heard by now, North Dakota is the #2 Oil Producing State

“We’re powering and feeding the world,” the Governor said. He also noted that North Dakota ranks high in broadband deployment — one of the most connected states in the U.S. As one of the top agriculture states, and arguably the most technologically advanced in ag tech, he said, “We need to have every combine connected!”

He went on to say that his state has one of the lowest unemployment rates, and that it needs more workers and education. “Our number-one priority is developing a larger, better educated workforce.”

The Main Event

Billed as a talk on “Tech, Trade, Turbulence, and the 2020 Election,” it was now time to hear from the keynoter, Rich Karlgaard. He began by saying he’s now been with Forbes for 28 years. (I remember when he began as editor of a brand-new publication called Forbes ASAP, after being a key team member of a ground-breaking Silicon Valley-based publication called Upside, which I loved and was where I first came to know him. I had the honor of introducing Rich at a huge event in downtown Minneapolis in 2000 — that will provide some more color about his early career.)

Rich kicked off by mentioning a couple of his recent books, “The Soft Edge” and “Team Genius.” The latter, he said, received praise from Satya Nadella, CEO of Microsoft, and — interesting tidbit — Rich noted that Satya once reported to Doug Burgum at Microsoft. Then Rich quickly dove into a hot topic of the moment, the 2020 elections, as the latest Democratic

Rich kicked off by mentioning a couple of his recent books, “The Soft Edge” and “Team Genius.” The latter, he said, received praise from Satya Nadella, CEO of Microsoft, and — interesting tidbit — Rich noted that Satya once reported to Doug Burgum at Microsoft. Then Rich quickly dove into a hot topic of the moment, the 2020 elections, as the latest Democratic train wreck debate had just happened the night before. His first slide spoke of “The Grim Logic of Money,” referring to the massive sums at play for Bernie and Bloomberg. He commented on some of the candidates, noting that Minnesota’s Amy Klobuchar “can’t get into orbit,” and that Nate Silver, the noted statistician, recently said Bernie will come up short of delegates, at only 1500-some, when 1991 are needed to get the nomination. He said it’s looking like a brokered convention this summer — “a mess like Chicago” (referring to 1968).

Rich dove right into a rapid-fire talk with many slides, touching on a whole array of topics. It was hard to keep up the note-taking, but I was trying:

GDP Growth Rates

Trump has averaged 2.6% 2017-2019. Obama averaged 2.2% 2009-2016. George W. Bush averaged 2.1% 2001-2008 (but that last year was the financial crash). With the you-know-what virus scare, GDP in Q1 2020 will not be good, he said. But he nonetheless sees 2.2 to 2.3% growth for the year — a solid “B.”

Reasons for Hope

“Stocks are still undervalued — there’s room to grow,” said Karlgaard. He noted the increase in housing starts in December of 16.9%. Combined mortgage and household debt is near the bottom of the recent historical range. Interest payments on federal debt as a percent of GDP are way down. And CEO confidence rebounded in Q4 according to the Conference Board. “Also, small business optimism is going up,” he said. “It dipped a bit in Q4 but remains high.”

Life in the Valley

Rich put up a slide of Peter Thiel, the noted conservative VC and billionaire founder, who used to be in Silicon Valley but now lives in LA. Not sure the subtle point there, but Rich made a funny comment: “We conservative Republicans in Silicon Valley could hold our quarterly meetings in a phone booth.”

Bits vs. Atoms

Speaking in North Dakota, Rich couldn’t help but bring up what he calls the “atoms industries” — meaning mining, agriculture, industrial production, manufacturing. The kinds of industries where it’s harder to raise capital — as opposed to the digital industry centered in Silicon Valley, where money flows. (But a side note here: North Dakota is also a major software hub, with the Microsoft Dynamics business in Fargo being one of the largest employers in the state.)

Calling a 2020 Winner

“Trump is favored by voters in the world of atoms,” he said. “Meanwhile, Dems assume they’re better at digital things.” The Obama campaign in 2012 “cleaned Mitt Romney’s clock,” with social media and other digital tools. But, Rich said, look out for Brad Parscale, Trump’s digital campaign manager in 2016, who’s now heading the entire campaign in 2020. He cited a commentator who calls him “smart and dangerous.”

So, the digital edge may be changing. “Look what the Dems did in Iowa!” Karlgaard exclaimed — meaning the big digital fail. He predicts Trump wins easily in November.

Tech Trends that Are “Mega”

So, where are things headed in tech? Rich’s Megatrend #1 is this: “The tech economy is not slowing down — it’s speeding up.” The old Moore’s Law essentially brought us a 30% improvement each year. But advances in semiconductors will soon be taking us from 30 billion to 60 billion transistors per chip. Taiwan Semiconductor just announced it will be opening a production facility for 3-nanometer silicon — a feat unheard of not long ago. He put up a slide citing “The New Engine of Disruption: Diane Greene’s Law” (she being the recent head of Google’s cloud division, and formerly a cofounder of VMware.) The new norm this brings us, says Karlgaard, is “a 60% annual improvement in digital bang for the buck.” He also quoted Scott Guthrie, head of Microsoft Azure: “Cloud not only scales up — it scales out, to users.” That referring to computing at the edge, which brings us advances like “near-instant trend analysis.” What industries will be transformed in the next decade? Here’s the slide:

Megatrend #2: “Extreme valuation creates asymmetric funding.” To illuminate, Rich cited the valuation of Tesla, currently at about $166 billion, as compared to GM at $49 billion. “Tesla’s getting free money,” he said. “They roll the dice! The investors want that.” GM, on the other hand, has investors that are primarily pension funds — and they don’t like or want change. What this trend results in, he said, is “repeated assaults to the profits of legacy companies.” And he couldn’t help but cite the current number of “unicorn” companies: it’s now up to 524.

Megatrend #3: “Digital awareness is becoming more important.” And here Rich delves into what the says are best practices — one being “cultural clarity.” Companies have to know who they are, what they’ll do, and what they won’t do. He showed what Fred Smith, CEO of FedEx, calls his triangle of health for companies: “Execution” on the left, “Values” on the right, and “Strategy” on the bottom. And he cited Scheel’s, a privately held, employee-owned sporting goods and entertainment chain headquartered in Fargo, which is “a good example of executing on its self-identity.” Another couple of best practices come out in his 2015 book, Team Genius: 1) small is better when it comes to teams, and 2) seek cognitive diversity — meaning both analytical and intuitive people. An example he cited: the pairing of two opposites at Starbucks: Howard Schultz and Howard Behar. When its rapid growth stalled, and customer service was suffering, the hard-charging Schultz promoted the other Howard to deal with the soft side of the business. Behar, not an analytical type and not even a college grad, was critical to the creation of what became Starbucks unique culture, eventually becoming president of Starbucks North America and Starbucks International. Another example of teaming: Fred Smith at FedEx had the “inside view” nailed, but he recruited a key outsider from Silicon Valley as a board member: Judy Estrin, who brought the digital view. Finally, Karlgaard talked about all the Silicon Valley technical-genius founders and cofounders with 800 math SAT scores: Woz, Zuck, and many other well-known names. “No HR manager ever got fired for hiring 800 scores!” But there’s a lot more to talent in the world of cognitively diverse teams in this digital age.

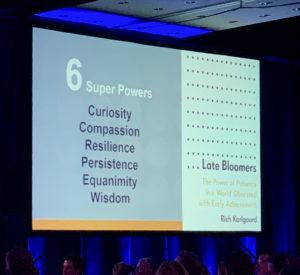

Do you know how many players got  drafted ahead of Tom Brady, he asked? There were scores of them — and he showed many of the names you’ve never even heard of. So the question he asks is, “How do you find more Tom Bradys?” That’s a topic Rich addresses in his most recent book, Late Bloomers (also coming out in paperback soon). And he gave us a brief list of what he puts forth in that book as his key “Super Powers” — shown in the slide here. (I have the book and recommend it — in fact, I brought it along to get Rich to sign it!)

drafted ahead of Tom Brady, he asked? There were scores of them — and he showed many of the names you’ve never even heard of. So the question he asks is, “How do you find more Tom Bradys?” That’s a topic Rich addresses in his most recent book, Late Bloomers (also coming out in paperback soon). And he gave us a brief list of what he puts forth in that book as his key “Super Powers” — shown in the slide here. (I have the book and recommend it — in fact, I brought it along to get Rich to sign it!)

During the audience Q&A following his talk, Rich made an interesting comment about Fargo-Moorhead: “I think it punches well above its weight. I see it as a smaller Austin TX or Columbus OH.” Yes, indeed — population isn’t everything. Intangibles matter.

As the event ended and Rich was being interviewed by a local TV station, I chatted with a few good folks I’d met, then jumped back into my car to get back home before dark. My head was buzzing all the way back down Interstate 94. So glad I made the trip!

Leave a Reply